A company that need to report its company applicants can have only up to two individuals who could qualify as company applicants:

If a reporting company has no principal location of enterprise from the U.S. and conducts company at multiple locale within the U.S., it may report as its Principal location the address of any of those areas the place it gets important correspondence.

F. 9. Have I met FinCEN’s BOI reporting obligation if I submitted a type or report that gives beneficial ownership data to some point out Place of work, a economic establishment, or maybe the IRS?

you'll find 23 types of entities which can be exempt within the reporting prerequisites (see problem C.2). diligently overview the qualifying criteria ahead of concluding that your company is exempt.

All data these cookies accumulate is aggregated and thus anonymous. If you do not let these cookies we will not know When you've got visited our site, and won't be capable to observe its efficiency.

The Reference tutorial explicitly states that the information provided therein is accurate as of July 2024 which is issue to vary Sooner or later.

specified subsidiaries of governmental authorities will also be exempt with the requirement to report beneficial ownership data to FinCEN. An entity qualifies for this exemption if its ownership interests are controlled (within their entirety) or wholly owned, directly or indirectly, by a governmental authority. Therefore, for instance, if a tribally chartered Company (or state-chartered Tribal entity) workout routines governmental authority on the Tribe’s behalf, and that tribally chartered corporation (or point out-chartered Tribal entity) controls or wholly owns the ownership interests of another entity, then each the tribally chartered Company (or state-chartered Tribal entity) Which subsidiary entity are exempt from the prerequisite to report beneficial ownership data to FinCEN. See queries L.3 and L.six for more information on this “subsidiary exemption.”

No. a 3rd-get together courier or shipping company worker who only provides paperwork to some secretary of condition or click here similar Workplace is not a company applicant offered they fulfill a single issue: the third-get together courier, the shipping and delivery provider employee, and any shipping and delivery assistance that employs them would not Enjoy another job during the creation or registration from the reporting company.

If a company development company only provides software, on line instruments, or usually applicable created direction that happen to be used to file a creation or registration doc for the reporting company, and personnel in the enterprise service are in a roundabout way associated with the filing of the document, the employees of these kinds of services aren't company applicants.

This will not be an exhaustive list of the problems under which someone owns or controls ownership interests inside of a reporting company by way of a believe in.

FinCEN’s smaller Entity Compliance guidebook features a checklist to aid recognize the data required to be reported (see Chapter 4.1, “What info ought to I gather about my company, its beneficial owners, and its company applicants?”).

For the purposes of figuring out that is a company applicant, It's not necessarily appropriate who signs the creation or registration doc, as an example, as an incorporator. to ascertain that's largely chargeable for directing or controlling the filing of the doc, take into consideration who's chargeable for building the decisions concerning the filing with the doc, such as how the filing is managed, what information the document incorporates, and when and where by the filing takes place. the subsequent 3 scenarios deliver illustrations.

In distinction, if a courier is used by a business formation provider, law firm, or other entity that plays a job from the generation or registration of your reporting company, such as drafting the related files or compiling facts to be submitted as A part of the documents sent, the conclusion differs.

detailing how different condition actors — which include from sanctioned jurisdictions, tax evaders, terrorist corporations and illicit actors of assorted forms — tap into U.S. expense field to circumvent sanctions and disguise illicit action.

Kel Mitchell Then & Now!

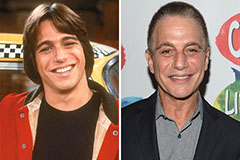

Kel Mitchell Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!